Get your insurances under control

Businesses and people alike are often unsure how much insurance they need. With lockr this question is answered.

Avoid under insurance and risking a financial loss as well as over insurance and excessive premiums by calculating exactly how much cover you need.

What are your assets worth?

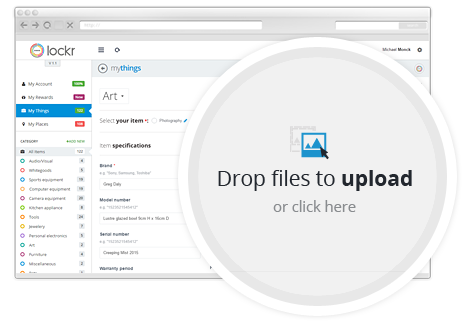

The first step in working out your insurance needs is knowing how much your assets are worth. This information is accessible in lockr along with the location of the asset and who is responsible for it.

Business intelligence about your asset values, who currently has it and its location together with how it is used will put you in the drivers seat when it comes time to renew your insurance.

Better prepared

It isn’t only insurance that matters. At tax time you’ll need information for depreciation. If a piece of equipment fails you’ll want to make a warranty claim. If you’re arranging finance with a bank they’ll want details on the value of your assets.

With lockr all of this information and more is at your fingertips.